accumulated earnings tax c corporation

For advice and counsel that can reliably help you. 93 Market Street Paterson NJ 07505 973-279-6077.

Distributions From S Corps Can Fund Life Insurance Premiums Bsmg Brokers Service Marketing Group

The tax is in addition to the regular corporate income tax and is.

. Filed its 1995 tax return showing a liability of 2674 which it paid in March 1996. A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons. May 17th 2021.

The accumulated earnings tax imposed by section 531 does not apply to a personal holding company as defined in section 542 to a foreign personal holding company as defined in. The tax rate on accumulated earnings is 20 the maximum rate at which they would be taxed if distributed. C corporations may accumulate earnings up to 250000 without incurring an accumulated earnings tax.

Appointment at 201 208-2200. The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of paying dividends. To trigger the tax you need to suffer an IRS audit that notes your failure to pay dividends when the corporations accumulated earnings exceed 250000 or 150000 for a.

The characterization of the. Our system imposes a 20 percent tax on accumulated taxable income of a corporation availed of to avoid tax to shareholders by permitting earnings and. Gladys M Minaya dba Gm Mutiservice LLC Gm Income Tax and Multiservice LLC.

IRC 1368 c 1. Converting your S corporation to an LLC takes careful planning and a detailed knowledge of both business entity law and the Tax Code. Its purpose is to prevent the accumulation of earnings if the reason for such is for shareholders to.

Find company research competitor information contact details financial data for Alcami New Jersey Corporation of Edison NJ. Taxpayers Assistance Center Inc. The accumulated earnings tax is a 20 tax that will be applied to C corporations taxable income.

Helps low income NJ and NY residents who have. If an S corporation has accumulated EP tax-free distributions generally can be made to the extent of the corporations AAA. Dba Navarro Tax Services.

Tax problems can be costly and confusing. The accumulated earnings tax is equal to 20 of the accumulated taxable income and is imposed in addition to other taxes required under the Internal Revenue. Get the latest business insights from Dun Bradstreet.

The accumulated earnings tax AET is a penalty tax imposed on corporations for unreasonably accumulating earnings in the corporation. The tax is assessed at the highest individual tax rate. Or call to schedule an.

However if a corporation allows earnings to accumulate. The accumulated earnings tax is considered a penalty tax to those C corporations that have. Metro Leasing and Development Corp.

Accumulated Earnings Tax is a corporate-level tax assessed by the IRS. The IRS audited Metros return and after modifying the companys. The accumulated earnings tax imposed by section 531 shall apply to every corporation other than those described in subsection b formed or availed of for the purpose of avoiding the.

A personal service corporation PSC may accumulate earnings up.

Pwc Doing Business In The Us 2015

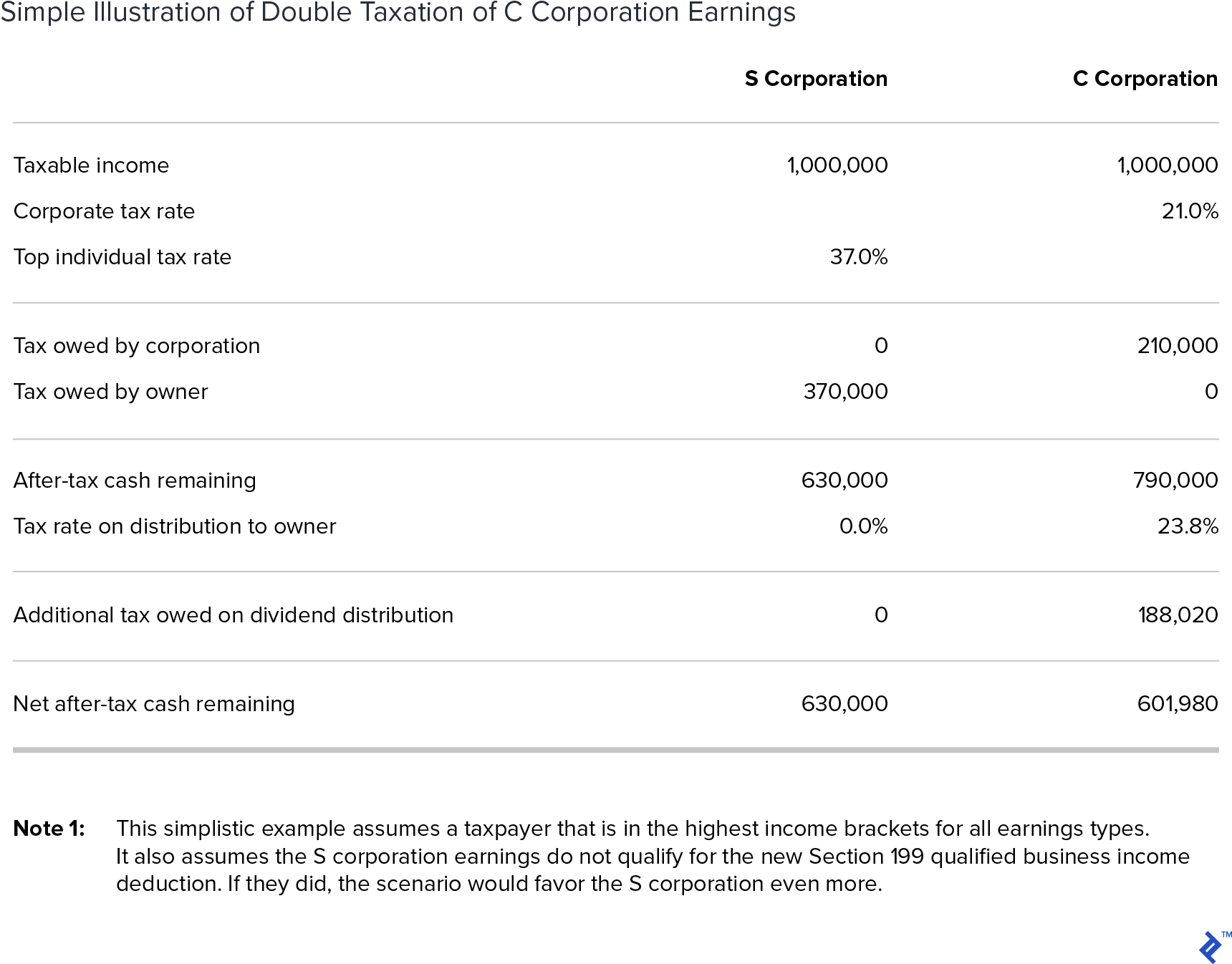

C Corp Vs S Corp Partnership Proprietorship And Llc Toptal

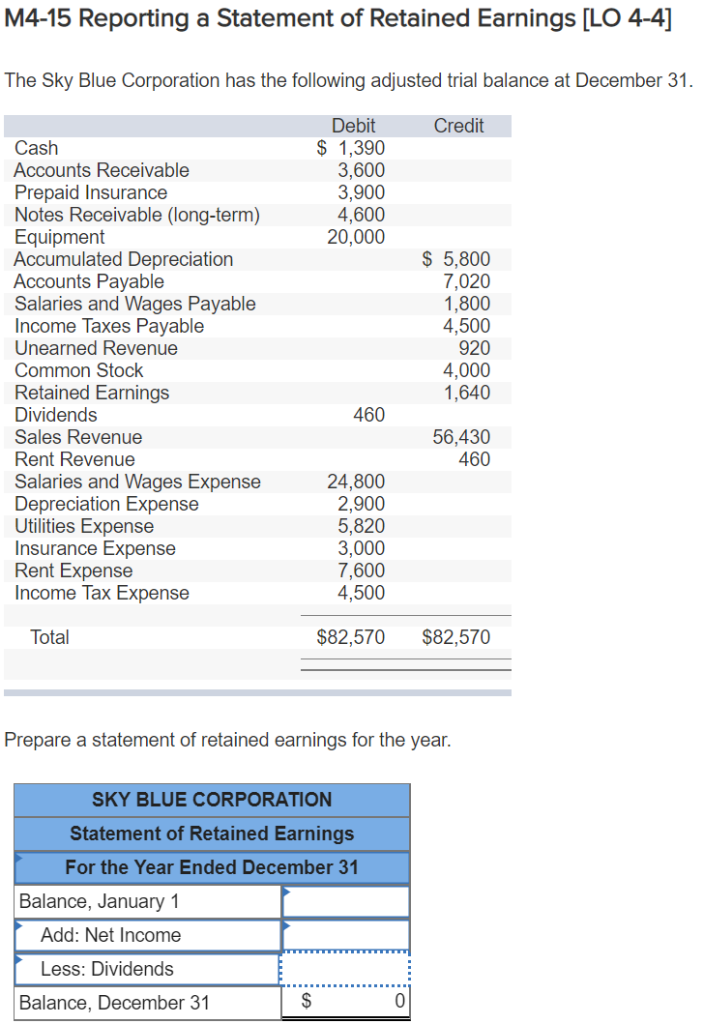

Solved M4 15 Reporting A Statement Of Retained Earnings Lo Chegg Com

Chapter 2 C Corporations Flashcards Quizlet

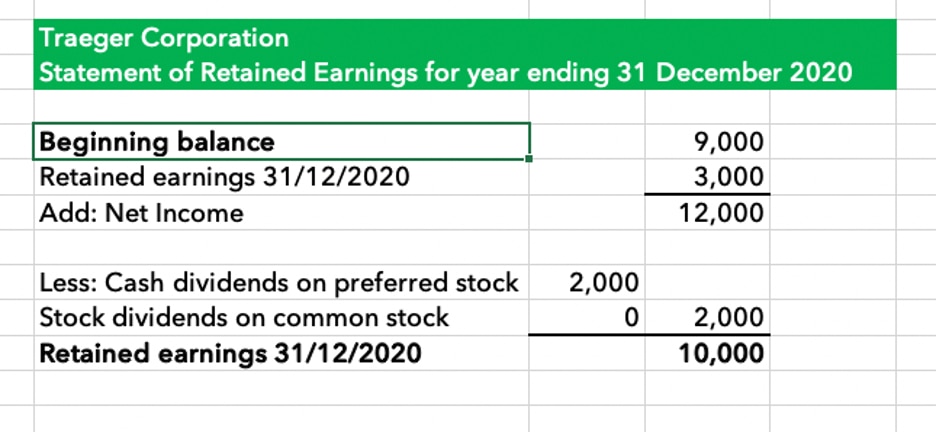

What Are Retained Earnings Quickbooks Australia

Principles Of Taxation Advanced Strategies Ppt Download

/BOA-f8957c5ee9c14788b59a7e5edd802a7b.jpg)

Which Transactions Affect Retained Earnings

Darkside Of C Corporation Manay Cpa Tax And Accounting

Overview Of Improperly Accumulated Earnings Tax In The Philippines Tax And Accounting Center Inc

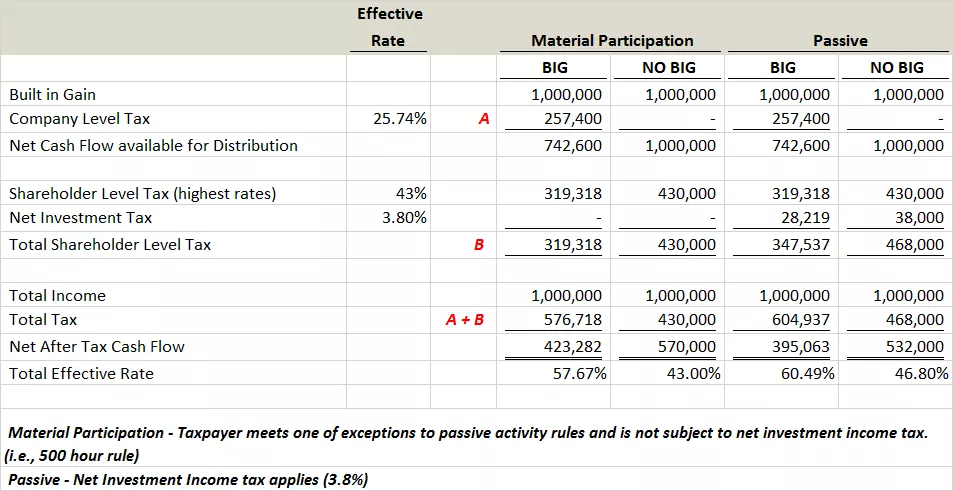

S Corp Rias Disadvantaged By The Tax Bill Mercer Capital

Darkside Of C Corporation Manay Cpa Tax And Accounting

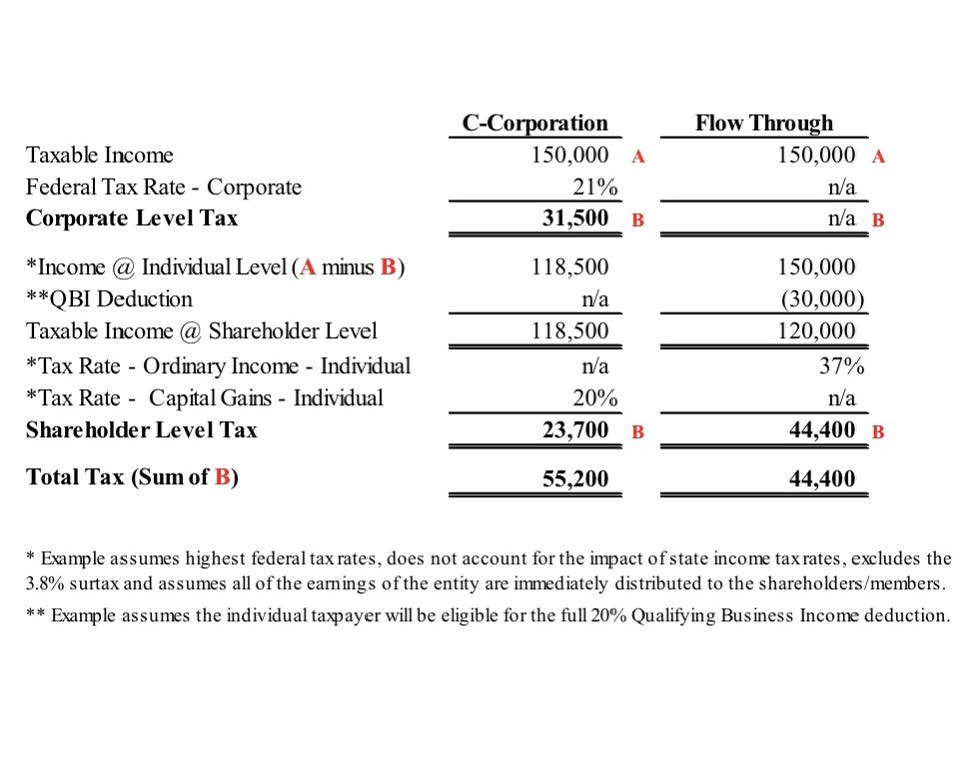

Tax Treatment For C Corporations And S Corporations Under The Tax Cuts And Jobs Act Smith And Howard Cpa

Tax Wise Ways To Get Cash Out Of Your C Corp Fulling Management Accounting

Significant Cuts To The Corporate Tax Rate Is It More Beneficial To Be A C Corporation Now Bernard Robinson Company

Business Tax Quick Guide Tax Year 2020 Journal Of Accountancy

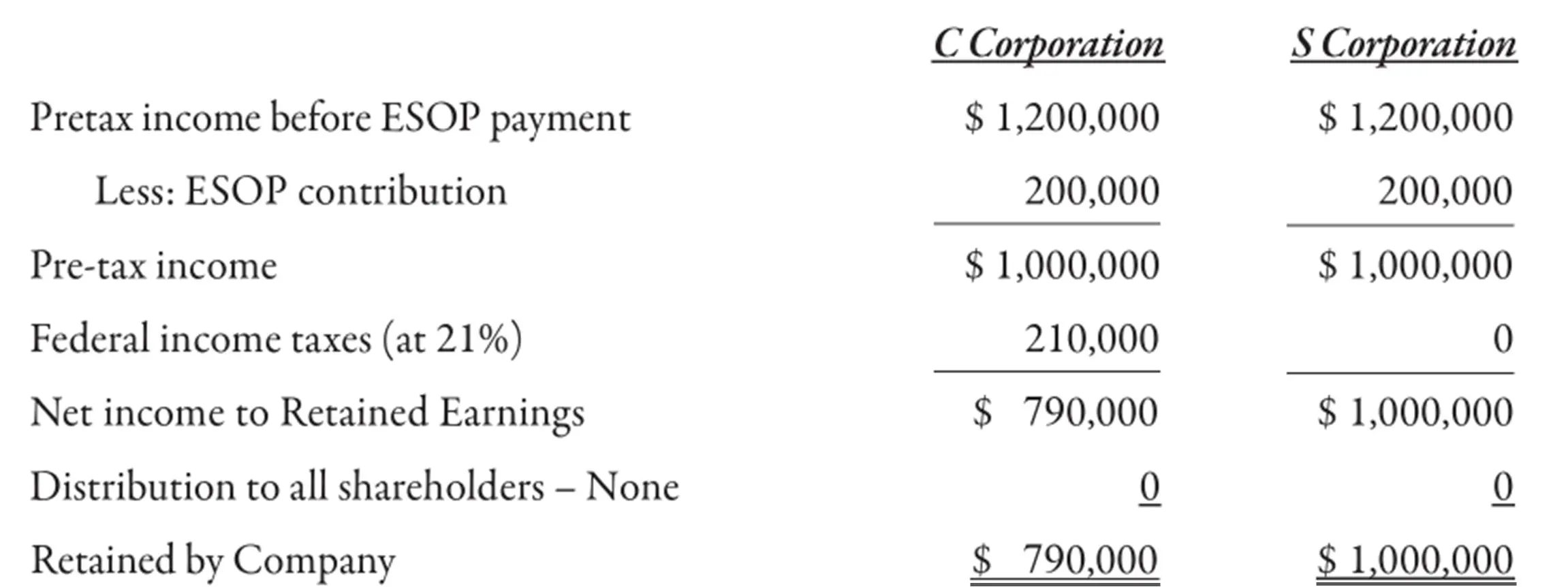

Is An Esop Right For Your Business Fort Pitt Capital Group

Corporate Tax In The United States Wikipedia

Determining The Taxability Of S Corporation Distributions Part I